🗞 Market commentary.

GM! Are we back? It certainly feels like it.

This week, Bitcoin showcased one of its historically favorite, lethal combinations – a true, authentic "Bullazooka" spectacle, right when the CT timeline was thick with geopolitical drama and black swan fantasies.

Not only is BTC now presenting itself in all its glory, right on time, there is also an undeniable de-correlation taking place between the price action of Bitcoin and the indices of traditional markets. Moreover, a brief reminder of the banking crisis of regional banks during this March brings back to mind that Bitcoin has a liking for banking system crashes (perhaps because the banks' life vests are emergency liquidity injections from the FED).

And now? What in the Uptober is this? The price action (and paper losses on long-term held securities) of many regional banks suggests another possible impending or even ongoing crisis. And all of that precisely during the fourth quarter, which is seasonally favorable for crypto, an inverse correlation to indices and banks, and last but not least during the period when Michael Saylor, the maxis high priest of BTC shilling, is passing the torch to Larry Fink in the race to launch an ETF. Yes, the spot kind of ETF that has the potential to shoot Bitcoin into a parabola similar to the one associated with the first gold ETF.

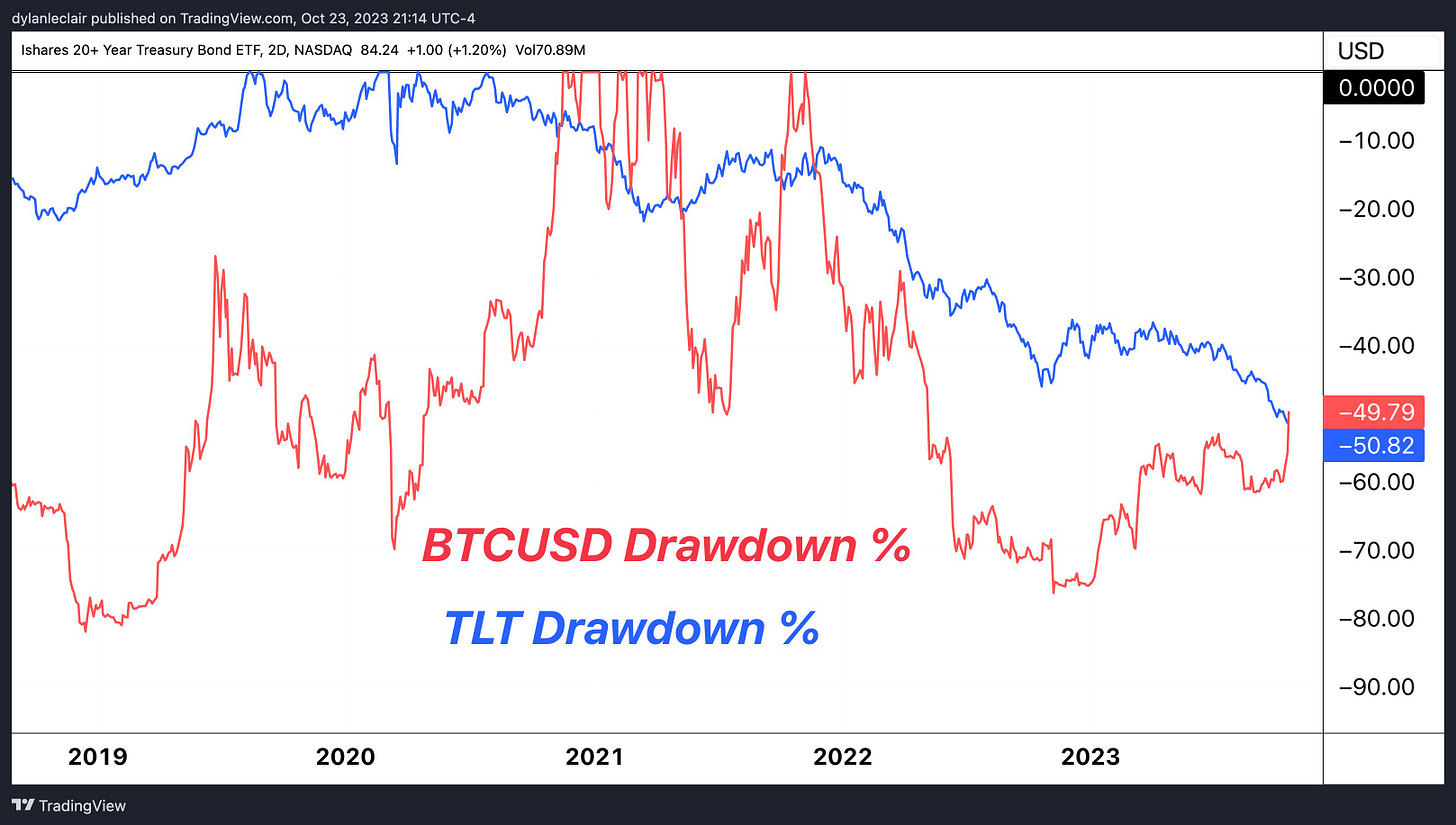

More cards are lining up, and if the following chart isn’t confirming the thesis of Bitcoin as a long-term store of value, then we really do not know what does, friends: long-term 20+ Year treasury bonds as the boomer tool for value preservation number 1, are now in a bigger drawdown percentage than Bitcoin. We do not see the flip in this chart for the first time – however, this time we see it at the beginning of a bull run, not at the end.

Lastly, let’s check up on MSTR. Since Saylor's company Microstrategy adopted the Bitcoin thesis, it became one of the best performing public companies, outperforming traditional assets like gold, silver, bonds and also indexes like Nasdaq.

There truly is no second best.

🤓 In today’s email.

Degen corner. From CEXs on Chain Lands: The Great Ape Migration

DeFi insights. 11 important updates for the hungry researchers

ICYMI. This week’s research & podcasts including Still Early Ep.3

Tweet of the day. Did Andrew Tate just mark the bottom for NFTs?

And finally. Be water, my friend.

🔥 Degen corner.

From CEXs to Chain Lands: The Great Ape Migration

What comes to mind when there’s talk about altseason? Massive pumps, volatility, and trading volumes. If volatility is war and traders are the troops, then exchanges are the military-industrial complex.

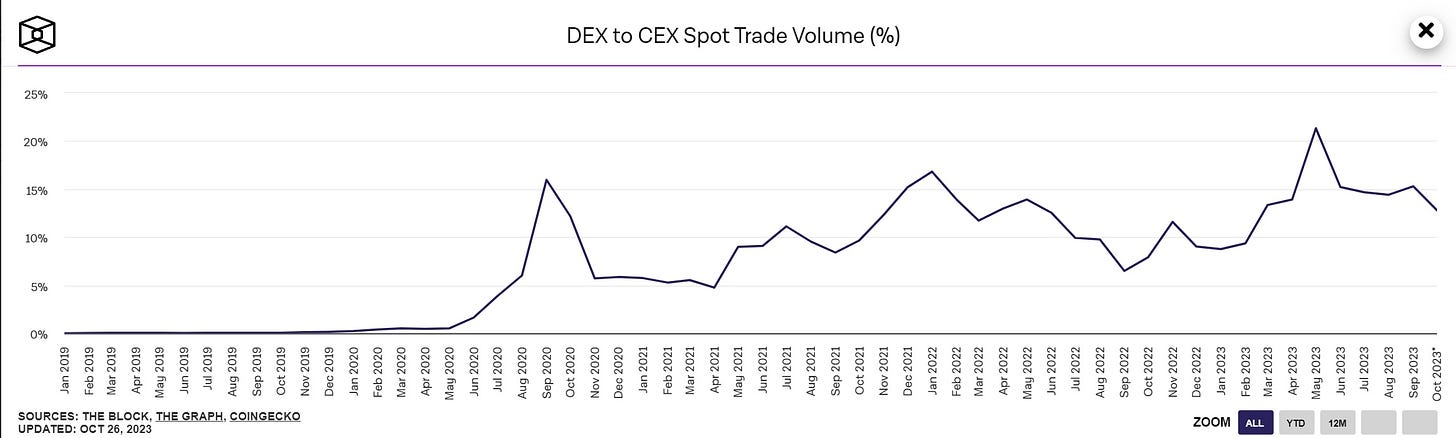

Maybe you’ve noticed the re-emerging PTSD on the timeline and the little rumours about the possibility of another CEX blowup. We won’t spiral down into a conspiracy rabbit hole here; however, one thing seems sure – this cycle, perpetual DEXs are poised to become an entirely new breed of financial machinery.

Moreover, as participants evolve, the level 2 types of DEX degenerates will be able to not just install MetaMask and dive on-chain more effectively, but in an attempt to hyper-gamble out of the inflation-ridden economy, they will also be able to pull the lever all the way to the right, safely, while being protected from an FTX-style blowup (please don’t try this at home).

For exactly this reason we‘re on the lookout for the “picks and shovels” of the next crypto rush. Not only is there a clear PMF along with CEX counterparty risk narrative, but the ability to dip right into revenues through staking and real yield is also attractive, naturally.

We all know GMX (if not check this article out), but what other sector leaders are emerging here, based on profitability and user numbers?

1. MUX

As a leading perpetual exchange, perp aggregator, and home for those seeking an extra dose of dopamine via 100x leverage, MUX has been moving smoothly in the market since 2020 without any stumbles. We have seen increasing interest in MUX since the start of October – platform fees during this month have risen from 20,000 USD to 150,000 USD daily.

Moreover, upon closer examination of the 180D statistics, a clear divergence can be observed between fully diluted market cap and fees: while the valuation dropped by 32% during this period, fees grew by 84%:

Just yesterday, MUX surpassed its previous market volume record, exceeding 467M in daily volume.

If you feel like testing MUX out, you can use this referral link for an immediate 10% discount on your trading fees (with the link, your fees will be 0.072%).

2. Vertex

Vertex is an upcoming protocol playing into the narrative of order-book DEXs, which are trying to get as close as possible to the user experience of CEX exchanges, and this approach may become dominant. After all, the vast majority of users are accustomed to the Binance style UX, and if they can land in a similar environment, they won’t have any reason to change it.

Vertex is currently just before the release of VRTX tokens and during the writing of this newsletter, the date of the upcoming Liquidity Bootstrapping Auction (LBA) was announced, scheduled for November 13th -> November 20th.

Despite the current absence of a native token, Vertex is performing well:

3. Hyperliquid

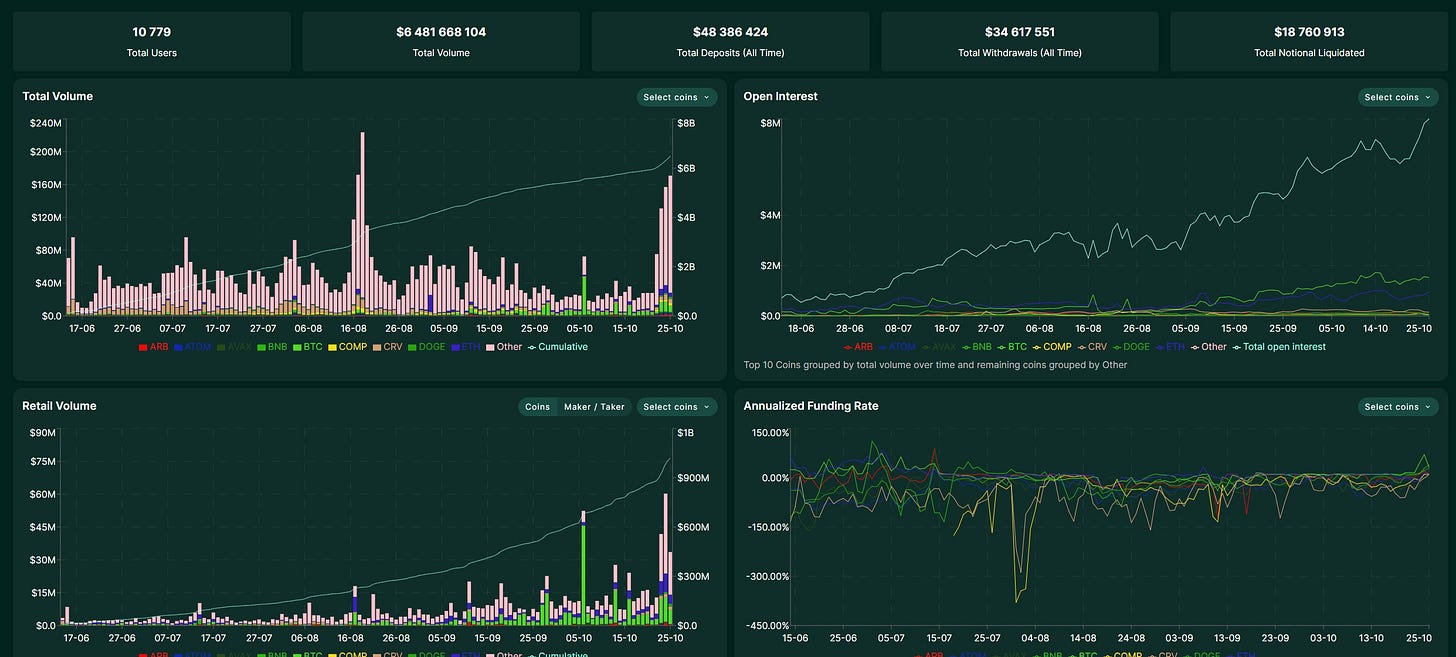

Hyperliquid is also a particularly interesting cat among perp DEXs as it’s running on its very own L1. Yes, that’s right. Moreover, Hyperliquid continuously gains new users by timely targeting and listing viral tokens or synthetic Friend.Tech perps. The tactic is clearly paying off – the platform has now exceeded 10,000 users, 6 billion USD in market volume, and 50 million in deposits:

Hyperliquid is also preparing to launch new Open Interest rewards next week, stay tuned.

👀 DeFi insights.

The important bits.

Layer Zero (Interoperability) – Smart contract update & $ZRO airdrop hints - read

Lybra (LSD & Stablecoins) – Rapid growth since v2 dropped - read

Yearn Finance (DeFi, Yields) – veYFI is here as Yearn prepares the biggest tokenomics revamp - read

Protectorate Protocol (NFTfi) – Huge tokenomics update (Buyback & Make) - read

Sudoswap (NFTfi) – Introducing NFT shorting option - read

Dopex (Options) – Liquidity migration to Camelot completed + juicy APYs - read

Rollbit (Exchange & GambleFi) – Volatility brings massive protocol revenues - read

Swell (LSD) – LPs soon to be eligible for LIQ token rewards on LiquisFi - read

Shrapnel (Gaming) – Showcase of in-game skins brings hype - read

Polygon (L2) – POL token upgrade is now live on Ethereum - read

Merit Circle (Gaming) – Beam token migration - read

📰 DeFi news.

Even more important bits.

“US fiscal policy is on an unsustainable path”, says Jerome Powell, once again feeding into macro fears - read

China continues to stimulate injecting $100B into the lending market - read

BlockFi emerges from bankruptcy as green candles seem to solve many problems - read

Vitalik backs Nocturn Labs which might bring us privacy accounts on Ethereum - read

Bitcoin CME futures hitting ATH as interest in crypto rises again - read

Lighting Network developer leaves citing security problems posing threat to Bitcoin - read

DoJ to consider charges against Binance as the CEX FUD is bubbling up again - read

🫠 ICYMI.

Life gets busy so here’s what you’ve missed.

Mozaic: A Bull Case

Research

Mozaic, a yield generator that leverages both AI and Omnichain tech, has flown under the radar, having launched just after some major runs by AI coins. This low profile makes it an interesting play for those looking for “the next big thing.”

Subnets vs L2s, Stars Arena and Off-Chain Assets

Podcast

Grant is joined by Luigi D'Onorio Demeo, Head of DeFi & Dev Rel at Ava Labs. In a varied chat, the two discuss everything from the beginnings of the Avalanche rush, how it felt to be a part of and how it came to be.

Tune in on Spotify | YouTube →

Infinitely better with Infinex

Research

A dive into how Infintex is putting UX at the forefront of everything they do, and why it's a guaranteed home run.

Is LPD-Fi The Next Big Crypto Narrative? With Orange Finance

Podcast

Dan sits down with the Orange Finance team to talk about two of the potentially hottest upcoming narratives in crypto, LPD-Fi and UniV4 Hooks.

Tune in on YouTube →

🐥 Tweet of the day.

To save you doom scrolling.

FRAG, we definitely would like to thank Andrew for providing a nice bounce (or even a meme bottom?) for the NFT market!

🦍 And finally…

For now, there truly is no second best than the Orange Coin, nevertheless – when it’s time and ETH/BTC resurrects, be prepared to act as water, my friend. To succeed and stack even more sats or other coins of liking, one has to be forward-looking like the markets themselves.

As soon as the market king BTC begins its rest and ends its dominance crusade, the true altcoin era shall inevitably begin, as is tradition.

We are rising up to the challenge once again, riding epic pumps, facing the emotions of missing out, enduring brutal drawdowns and keeping it together as the portfolio glitches under volatility only to be seen in crypto lands.

It’s all coming, and it seems right around the corner. Are you ready?

much love,

blocmates team 🫡

🤝 A final word.

A quick word from our super awesome sponsors who help us make this all possible...

Discover how your skills could power the next generation of web3 and blockchain technology. Your next career move could be one you never imagined. Start your search today at Web3nomads.jobs.

Much love🫡