🗞 Market commentary.

Grand Morning to you fellow alpha researchooors.

Whether you’re an old-school crypto ape or one of the newly minted geopolitical experts, you’ve come to the right place.

Peering into the current chessboard: we've perhaps just had one of the craziest weeks ever. While the ‘reply guys’ are desperately trying to take a stand on a region they couldn’t locate if it was tattooed on their foreheads, crypto experts are now salivating, waiting for some long-deserved volatility. After all, Bitcoin has been hovering around the same price since *checks notes* March of this year.

Is there still something worthy in this market, or is it better to accumulate stablecoins? While emotions point towards a strong bearish thesis, our favourite markets have so far shown relative resilience:

DXY, at first glance, smells like (a temporary) peak and a necessary decline after a historical 12-week rise, NASDAQ sketches out a possible bull-flag and on the ETH/BTC side, the sellers never seem to get exhausted.

Across the board, with the total fright of market participants, is there any hope for the fulfilment of the promised month called "Uptober"?

This whole situation triggers a mental flashback to a time before the “what shall not be named” crash period is now underscored by the VVIX/VIX volatility chart, which literally mirrors the action before March 2020.

All these factors are worth keeping in mind, as we dive back into the crypto lands and more importantly – The (Stars) Arena:

Hope dies last, and this rule once again holds true now for StarsArena: “We have recovered approximately 90 % of the lost funds. … Total funds lost: 266,104 AVAX. Total funds returned: 239,493 AVAX.” StarsArena

Moreover, the main man Locrian prepared brand new contracts, backed by audits from Paladin Blockchain Security.

Are you itching to return to the Arena and test things out? Rest assured, you're not the only one. The buzz this SocialFi platform created was undeniable – it's time to see if a real resurgence is on the horizon.

Lastly - something seems to be cooking in the NFT space, more precisely at Hyperspace AVAX Multichain Marketplace - Awards, anyone? (Wen Token?!)

🤓 In today’s email.

Degen corner. Arbitrum STIP: The Winners & Wildcards

DeFi insights. The exact right blend of news from the depths of crypto.

ICYMI. Official Still Early Podcast Release, Swell Voyage 2 & PintSwap

Tweet of the day. A short story about how a Threadooor got got.

And finally. Stay tuned…

🔥 Degen corner.

Arbitrum STIP: The Winners & Wildcards

Regardless of the macro, regardless of the price – Degens are looking for one thing and one thing only, and that is a chance for an upcoming pump.

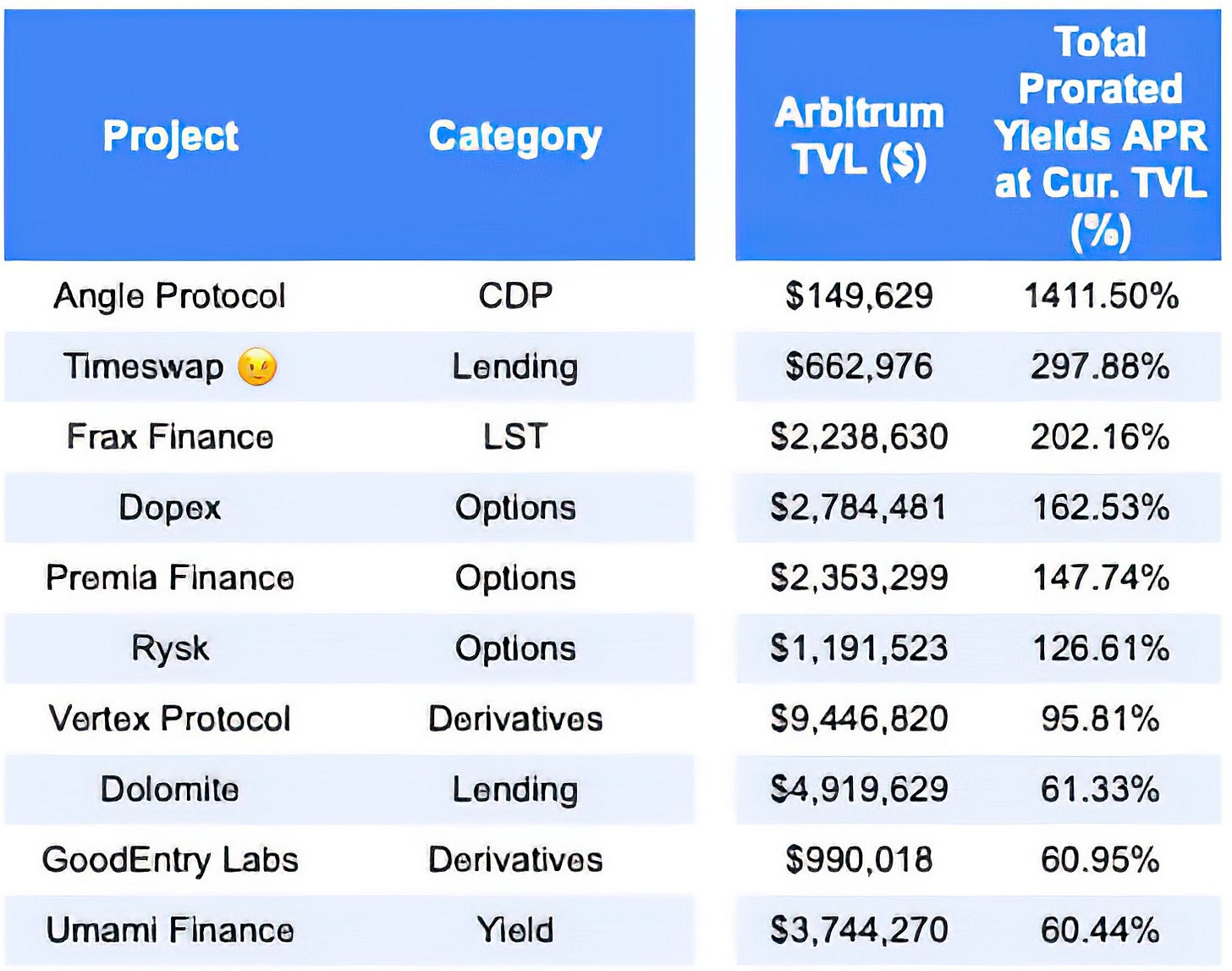

STIP has now concluded, and we have 29 projects precisely prepared for the return of the Arbitrum season! Now it's time to list all the projects deserving of a stimulus in the form of ARB tokens, select from the juicy APR offers, and lastly, choose your favorites.

If you want to quickly cut through the noise, you're in the right den: below you'll find 3 promising Arbitrum horses (PLUS some underdog pics) along with explanations of the projects.

DPX & RDPX

The tried-and-true original in the on-chain options category and a darling of the well-known crypto whale, Tetranode, is beginning to shine like a diamond once again. From a quorum statistics perspective, Dopex is emerging as one of the most dominant leaders, almost on par with the long-dominant Arbitrum project, GMX.

Dopex continues to be fueled by the ongoing narrative surrounding the highly anticipated V2 version of RDPX, set to launch during the first half of November. If the Crypto Gods are merciful and don't plunge us into another bearish phase, RDPX will be one to keep an eye on.

Choose your position carefully: succumbing to FOMO or buying into green candles is strictly off-limits.

MUX Protocol

Not only is MUX at the forefront of the quorum STIP statistics as a high APR winner, but the protocol's native token, MCB, also maintains a year-over-year price increase along with a growing market volume.

PS. Check out our MUX vs the REST Perp DEX Comparison article

Jones DAO

Jones is a familiar face in the DeFi leadership within the Arbitrum ecosystem, offering capital efficiency strategies to those looking for premium parking of various tokens. A modest market cap combined with winning the STIP elections makes Jones DAO worth a glance.

Besides these, feel free to explore other potential STIP frontrunners (and a few underdogs):

And a few underdogs:

There's more to dive into, naturally - so take a peek at the aforementioned winner table. But remember the market dynamics we discussed earlier, anon – no incentive can stand against market forces if everything topples due to overarching macro pressures. Timing, as they say, is everything.

👀 DeFi insights.

The important bits.

UnstoppableFi (DEX) – 0xNic shows a new frontier of seamless UX - read

Immutable (Web 3 Gaming) – Roadmap to zkEVM Mainnet and plan to support upcoming AAA game launches - read

Solana (L1) – Latest updates bring native support for private transactions - read

FRAX (DeFi & RWA) – Frax launches $sFRAX, earning 10 % T-Bill yield - read

Metis (Ethereum L2) – Announcing a comeback to being a pure Optimistic Rollup - read

Synthetix (DeFi; Derivatives & RWA) - Soon launching Perps on BASE, aiming to dominate - read

GMX (Perpetuals) – V2 Open interest looking very good + GMX is a clear STIP winner - read

DYDX – Planning a transition from a rollup to an app-chain - read

Redacted Cartel X Pendle – Introduces “Yield Stripping” – pxETH will be split into yield and principal token using Pendle contracts - read

IPOR Labs (Interest Rate Markets) – Audit by Ackee Blockchain now complete - read

Hyperliquid (Order Book Perpetuals L1) – Introduces TWAP orders and pair Trades, enabling users to long BTC and short ETH in one trade - read

📰 DeFi news.

Even more important bits.

Uniswap Introduces Project Mariana with Bank of International Settlements (BIS) – a new report on how bankers are planning to use blockchain for international settlements. Interesting point – BIS & Mariana have been directly looking into Curve and AMM tech for almost a year now - read

Thorchain gets a CIA door knock? Introduces Chain Surveillance – Thorchain was reported as #1 DEX by volume on DeFiLama – shortly after reports of it being used by the FTX hacker came about with the implementation of chain surveillance tech right after - read

Crypto DEX Trader Joe Sued by Grocery Chain Trader Joe’s – who would have thought? – read

Blackrock & JPMorgan Launching a Tokenization Platform (TCN): Oh look who we got being bullish on the good old tokenization? - read

Alameda Responsible for Minting $39.55B USDT (47 % of Tether Circ. Supply): If you think the 2021 bull run stank - you are right - read

🫠 ICYMI.

Life gets busy so here’s what you’ve missed.

Still Early Podcast Ep.1: The Past, Present & Future of Trader Joe with Crypto Fish

Listen & Watch.

Crypto Fish and Grant delve into Trader Joe's history, present, and future, exploring topics like Fish's crypto origins, Trader Joe's origins in response to another project's incompetencies, and upcoming developments for the protocol and community.

Tune in on Spotify | YouTube →

Swell: Introducing Voyage 2

Research.

Swell’s Voyage 1 campaign was a tremendous success, attracting over 48,000 staked ETH. Today, we’re going to show you how you can earn some more pearls through their Voyage 2 campaign.

A look at PintSwap: The P2P OTC Orderbook DEX

Research.

Digging into the tokenomics, structure and offering of PintSwap a P2P orderbook DEX with more offers than meet the eye for your average degen.

🐥 Tweet of the day.

To save you doom scrolling.

0xtuba, bringing Carolines fashion mainstream

🦍 And finally…

It seems that even the Bitcoin community has developed a craving for genuine, tamper-proof, turing-complete contracts. Are we on the brink of a shitcoin season and a good old DeFi summer on Bitcoin? The Ethereum vs. Bitcoin showdown is becoming increasingly riveting:

Not just that: one of the key players striving to build Ethereum on Bitcoin is the Botanix Labs team.

So, there we have my dear frens. It’s a whole lot of ups, downs and sideways… If the current situation mentally drains you and you don't know which way to turn, remember that at least you're not in the shoes of maestro SBF, against whom his ex, Caroline (in a Milady outfit), is currently testifying without leaving any details behind (yes, he really told her he wanted to become a president).

In the end, we can't say goodbye to you with anything other than a quote from the dev gigabrain Magnus:

There are plenty of uncertainties ahead along with many challenges. But if my time in crypto has taught me anything, it's to embrace the long view. Build for users of tomorrow, not just for today. - Magnus

much love,

blocmates team 🫡

🤝 A final word.

A quick word from our super awesome sponsors who help us make this all possible...

Discover how your skills could power the next generation of web3 and blockchain technology. Your next career move could be one you never imagined. Start your search today at Web3nomads.jobs.

Whilst it's great to hear the users of Stars ARENA have only lost a portion of their funds this project is still a massive red flag. Multiple security vulnerabilities this early in the project's life point to the high chance of there being even more in the future. When team favours shipping over security, and hype over QA, then the end result is sadly predictable.

Given friend.tech is currently seeing successful SIM swap attacks, and don't seem to have a plan to mitigate this, I wonder if Stars ARENA have any exposure here?

The Arbitrum STIP campaign requires projects to post regular updates on the progress and performance of their token allocations to the governance forums. Will blocmates be checking back in regularly to see how the projects are doing?

Just skimming through some of the proposals I didn't see any that didn't involve giving away a bunch of ARB.

I wonder if there's a better way to allocate these grants. Possibly giving tokens out as a no interest loan? It would force projects to plan for paying it back and the foundations could use the defi lenders on chain to facilitate them thus helping drive more usage.